We are global and we are committed to contribute to a sustainable agriculture in each market we serve. With a high level of technical agronomic knowledge and the availability of resources of natural origin, we deliver a premium product portfolio for sustainable, high yield and efficient crops.

At SQM, Sustainability is a core value that drives us to constantly take on new environmental challenges and commitments that are aligned with the aspirations of neighboring communities, our workers, customers, contractors and the diverse stakeholders with which we engage.

In this spirit, we built our Sustainability Aspiration around three cornerstones: solutions for human progress, our people and our environment. The plan was developed based on the United Nations Sustainable Development Goals (SDG).

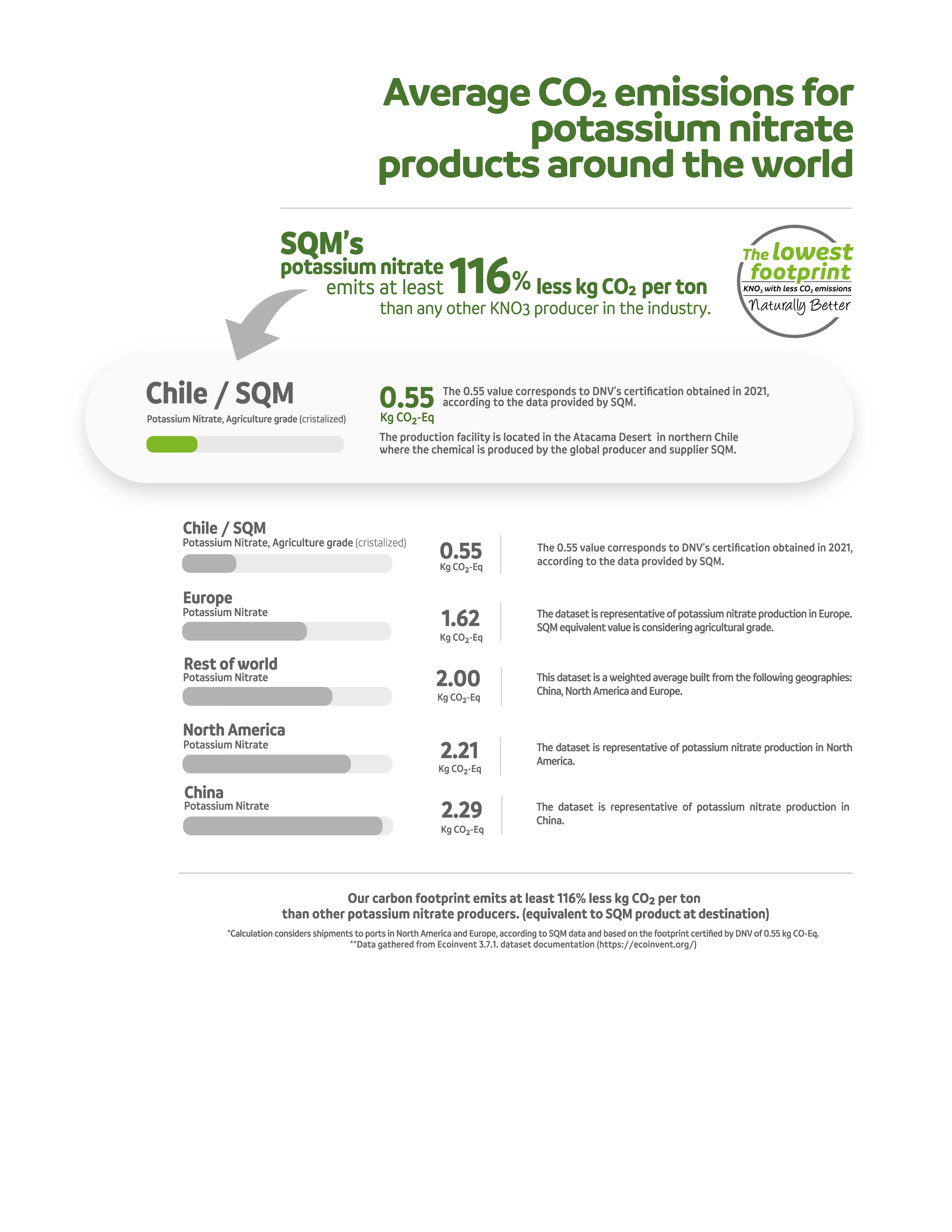

As the worldwide leader in the production and commercialization of potassium nitrate we care how our core product impacts in the world, worrying about environmental, natural and crop health. We strongly believe on the potential of our products to contribute to the highest level of yield, using as less resources as possible. We also keep close track of our KNO3 footprint emissions and we are very proud that it has the lowest emissions in the industry.

Together, the new investors will bring The Yield Lab Latam's fundraising for its third fund to more than US$20 million, with a target of US$50 million by the end of the year, and a goal of investing in 30 Latin American agribusiness companies over the next four years.

IDB, the innovative arm of the Inter-American Development Bank; the Bimbo Group, the world's largest bread producer; Latam Impact Fund, a fund managed by Sonen Capital and Fondo de Fondos; and SQM, a Chilean producer and developer of essential products for human progress, including health, nutrition, renewable energy and technology, have joined as limited partners of The Yield Lab Opportunity Fund, a venture capital fund specialized in investing in agricultural and food technology in Latin America and the Caribbean.

The fund aims to invest in 30 companies in the Seed and Series A/B stages in Latin America and the Caribbean. It is managed by The Yield Lab Latam with investors from the Agtech Garage network in Brazil, Nesters in Argentina and Agcenter in Colombia.

The goal is to raise US$50 million to invest in startups that are reshaping the agrifood value chain in an inclusive, transparent, innovative and disruptive way. Since its inception, The Yield Lab Latam has been supported by renowned innovation market players and institutional investors from several Latin American countries to promote innovation in the food technology and agriculture sector, as well as to bridge the gap between the agrifood and venture capital ecosystems across the region.

"The food value chain is changing and, as a major producer and developer of specialty nutrients, we want to be part of this change. Together with the fund, we expect to identify disruptive technologies and business models that, combined with our competitive advantages, will allow us to maintain our leadership position in high-value crops," commented Pablo Altimiras, SQM's Executive Vice President of Nitrates & Iodine.

"Our investors are agents of change, such as growers, corporations and agrifood suppliers committed to a sustainable future. We help connect them with regional solutions from throughout Latin America, providing strategic visibility to build a path of innovation and generate solutions to business challenges on a regional and global scale."

With this deal, The Yield Lab Latam consolidates its position as one of the leading AgriFoodTech investment firms in Latin America over the past five years, a period in which it has launched three investment funds and invested in 19 companies in seven countries," according to a statement from The Yield Lab Latam team members Tomás Peña, Kieran Gartlan, Santiago Murtagh, Roberto Vitón and Camila Petignat.

These four new investors join growers and family-owned companies in the agricultural supply chain that participated in the first closing of the Opportunities Fund, including SURCOS S.A., an Argentine agricultural inputs company; Petrovina, a Brazilian seed company; and Damha Agro, a large Brazilian agricultural group.

About The Yield Lab Latam

The Yield Lab Latam is part of a global network of venture capital funds focused on AgriFood Tech, which started its activities in St. Louis, Missouri in 2014. The network is now present on four continents, including North America, Europe, South America and Asia Pacific.

The Yield Lab Latam was founded in 2017 and has offices in Argentina, Brazil, Mexico and Chile. The fund's thesis is to invest in Latin American-based companies across the full spectrum of agrifood innovation, from farm to fork.

About IDB Lab from the Inter-American Development Bank (IDB)

IDB Lab is the innovation lab of the Inter-American Development Bank Group, the leading source of development finance and expertise for improving lives in Latin America and the Caribbean.

The purpose of the IDB Lab is to drive innovation for inclusion in the region by mobilizing funding, knowledge and connections to test sector solutions with the potential to transform the lives of vulnerable populations affected by economic, social and environmental conditions.

Since 1993, the IDB Lab has approved more than US$ 2.0 billion in projects in 26 countries in Latin America and the Caribbean.

About the Bimbo Group

The Bimbo Group is the world's largest and leading bakery company and a major player in snacks. The Bimbo Group has 214 bakeries and plants and more than 1,600 sales centers strategically located in 34 countries in the Americas, Europe, Asia and Africa. Its main product lines include sliced bread, buns and rolls, pastries, cakes, cookies, toast, English muffins, bagels, tortillas and flatbreads, savory snacks, confectionery products, among others. The Bimbo Group produces more than 10,000 products and has one of the largest direct distribution networks in the world, with more than 3.3 million points of sale, more than 55,000 routes and more than 141,000 employees. Its shares are traded on the Mexican Stock Exchange (BMV) under the ticker symbol BIMBO, and in the U.S. over-the-counter market with a Level 1 ADR, under the ticker symbol BMBOY.

About Latam Impact Fund

The objective of the Latam Impact Fund is to offer investors the opportunity to invest in the fastest growing sectors of the Latin American economy, with the objective of obtaining attractive financial returns combined with a positive social and environmental impact. The fund supports entrepreneurs and fund managers who intentionally want to make an impact by contributing to the United Nations Sustainable Development Goals ("SDGs"). This fund is managed jointly by Sonen Capital and Fondo de Fondos.

About SQM

SQM is a global company listed on the New York and Santiago stock exchanges. It is an integrated producer of iodine, lithium, industrial chemicals, potash fertilizers and specialty plant nutrients, including potassium nitrate, sodium nitrate, sodium potassium nitrate and specialty blends. SQM’s potassium nitrate is a natural, chlorine-free and highly soluble fertilizer that optimizes water use in agriculture when applied using the most sophisticated irrigation technologies, thereby increasing the quality and yields of high value crops. Its specialty nutrients are sold in over 100 countries to more than 1,200 customers, with Latin America accounting for 25% of sales.

Iodine is used in a wide range of medical, industrial and agricultural applications and in human and animal nutrition products.

Lithium and its derivatives are mainly used in electrochemical materials for batteries for electric vehicles, laptops, tablets, cell phones and electronic devices, frits for the ceramic and enamel industry, heat-resistant glass (ceramic glass), the lubricating grease industry and lithium derivatives.

Lastly, SQM has an integrated value chain, from production to sales, offering high-value products to its customers.

Operations in Chile

In addition, 90% of the energy used in the production process comes from the sun.

SQM has approximately 4,000 hectares of solar evaporation ponds, allowing it to take advantage of significant amounts of energy.

This method is only possible because the Atacama Desert has extremely high levels of solar radiation, which results in high evaporation rates and facilitates the process of concentration of salts in ponds throughout the year.

·This method is only possible because the Atacama Desert has extremely high levels of solar radiation, which results in high evaporation rates and facilitates the process of concentration of salts in ponds throughout the year.

You can learn more about our production process here: https://sqmnutrition.com/en/about-us/

This production process makes it the KNO3 source with the lowest Greenhouse Gas emissions in the industry.

This calculation estimates the carbon footprint (t CO2 equivalents) related to the production of potassium nitrate fertilizer by metric ton. All emissions with GWP (Global Warming Potential) are included, and all the direct and indirect emissions from all materials directly related to the production of the particular fertilizer products listed in the Annex and delivered at the harbor.

Additionally, the calculation includes the estimated emissions from purchased energy and indirect emissions resulting from the production and transportation of raw materials and final products.

We will send you a link to your email, then you will follow the instructions that will appear to retrieve your password.

This website uses its own and third-party cookies to collect information in order to improve our services, to show you the advertising related to your preferences. If you continue browsing, it implies acceptance of their installation. The user has the possibility to configure his browser, if he wishes, to prevent them from being installed on his hard disk, although he must bear in mind that this possibility can be useful in navigating the web page.

For more information read here ACCEPT